DAO under fire over $23M fund misuse claims

In the evolving landscape of decentralized finance (DeFi), transparency and trust remain paramount. However, recent allegations against the founders of Across Protocol have raised serious concerns about governance integrity within decentralized autonomous organizations (DAOs). The accusations revolve around claims that the team behind Across Protocol manipulated DAO votes to divert $23 million in tokens to their affiliated for-profit company, Risk Labs. This situation not only challenges the credibility of the protocol but also shines a light on broader issues facing DAOs in their quest for legitimacy and accountability.

The Allegations Unfold

The controversy began with a Friday thread on X, where pseudonymous founder Ogle of layer-1 project Glue took to social media to air his grievances. He accused the founders of Across Protocol of engaging in covert practices that undermine the very principles upon which DAOs are built. According to Ogle, these practices render such organizations as mere facades—“DAOs that are DAOs in name only.” The crux of his accusation is that governance mechanisms were manipulated to funnel substantial funds away from community interests and into a private entity.

At the center of this storm is Hart Lambur, co-founder of both Risk Labs and Across Protocol. In response to the allegations, Lambur vehemently denied any wrongdoing. He emphasized that Risk Labs operates as a nonprofit based in the Cayman Islands and lacks traditional shareholders. Furthermore, he provided a certificate of incorporation to bolster his claims, asserting that the organization functions under fiduciary obligations—a crucial point for maintaining trust among stakeholders.

Implications for DAO Governance

This incident raises critical questions about governance structures within DAOs. As more projects emerge under the banner of decentralization, ensuring genuine community involvement in decision-making processes is essential. Critics argue that without robust mechanisms for accountability, DAOs risk becoming vulnerable to manipulation by those at the helm—potentially leading to misuse of funds intended for community development.

The situation with Across Protocol serves as a cautionary tale for other projects operating within this space. It highlights the need for transparency in governance and calls for enhanced scrutiny over how voting mechanisms are implemented and monitored. If communities cannot trust their leaders, the very foundation upon which these decentralized entities stand could be compromised.

A Call for Greater Accountability

While Lambur has opened himself up to legal repercussions should misuse be proven—stating that directors can be sued—it remains imperative for DAOs like Across Protocol to implement measures that preempt such controversies. Transparency reports, independent audits, and clear communication channels between founders and token holders can foster a more trustworthy environment.

As this story unfolds, it will be interesting to observe how both the community surrounding Across Protocol reacts and how other DAOs respond to this incident. Will they take proactive steps to enhance their governance frameworks? Or will they remain indifferent until faced with similar allegations?

Nonprofit Status Called into Question: The Case of Risk Labs

In recent discussions surrounding the legitimacy of nonprofit organizations, one case has stirred considerable interest: Risk Labs, a company registered in the Cayman Islands. As the world increasingly scrutinizes the operations and classifications of nonprofit entities, this situation raises pertinent questions about transparency and accountability in the nonprofit sector. the implications of Risk Labs’ claimed nonprofit status, its incorporation details, and what this means for stakeholders and the broader community.

What Are Foundation Companies?

Foundation companies are a distinctive form of legal entity established under Cayman Islands law. They can be formed for various purposes—commercial, charitable, philanthropic, or private—making them versatile tools for different types of organizations. According to Harneys, a prominent law firm specializing in Cayman Islands law, these entities are characterized by their “ownerless” nature; they do not issue shares and cannot pay dividends. This structure allows foundation companies to operate independently from traditional ownership models.

The absence of shareholders means that foundation companies are often viewed as more stable than other business structures. They can be particularly appealing for organizations that prioritize long-term sustainability over immediate profits. However, it is crucial to distinguish between nonprofit and for-profit foundation companies, as they operate under different guidelines.

Nonprofit Status Called into Question

In recent discussions surrounding the legitimacy of nonprofit organizations, one case has stirred considerable interest: Risk Labs, a company registered in the Cayman Islands. As the world increasingly scrutinizes the operations and classifications of nonprofit entities, this situation raises pertinent questions about transparency and accountability in the nonprofit sector. The implications of Risk Labs’ claimed nonprofit status, its incorporation details, and what this means for stakeholders and the broader community.

Understanding Nonprofit Status

Nonprofit organizations play a crucial role in society by providing services that may not be adequately addressed by for-profit enterprises or government initiatives. These organizations are typically recognized for their altruistic objectives and are granted tax-exempt status under various jurisdictions. However, to maintain this status, nonprofits must adhere to strict regulations regarding their operations and financial practices.

In the case of Risk Labs, the company’s certificate of incorporation describes it as a “foundation company.” While this designation is often associated with charitable or philanthropic endeavors, it is important to note that Cayman Islands foundation companies can have diverse purposes—commercial, charitable, or private—according to legal interpretations from firms such as Harneys.

The Controversy Surrounding Risk Labs

Cointelegraph recently reported on Risk Labs’ claimed nonprofit status but encountered challenges in verifying it. The organization’s name did not appear in any official list of registered nonprofit entities in the Cayman Islands. This discrepancy raises significant concerns about transparency and compliance within the nonprofit framework.

Cayman Islands-based foundations are unique in that they are typically categorized as “ownerless” entities and are prohibited from distributing dividends. Legal experts at Ogier emphasize that while these foundations cannot operate like traditional for-profit companies with shareholders, they can still make distributions to beneficiaries. This nuance complicates the classification of organizations like Risk Labs and calls into question whether their operations align with their stated mission.

Implications for Stakeholders

The uncertainty surrounding Risk Labs’ nonprofit status has implications that extend beyond just legal compliance. For stakeholders—including donors, beneficiaries, and regulatory bodies—the lack of clarity can lead to mistrust. Potential donors may hesitate to contribute if they perceive a lack of transparency regarding how funds are utilized. Similarly, beneficiaries may question whether they will receive support from an organization whose operational structure is ambiguous.

Moreover, regulatory bodies might find themselves challenged in enforcing compliance if organizations misrepresent their status or fail to adhere to established guidelines. This could undermine the integrity of the entire nonprofit sector if not addressed effectively.

Claims of DAO Vote Manipulation

Decentralized Autonomous Organizations (DAOs) are heralded for their promise of democratic decision-making. However, recent claims surrounding the Across/Risk co-founders and insiders have raised serious concerns about the integrity of these governance processes. Allegations suggest that certain individuals orchestrated governance proposals that undermined the very principles of democracy within the DAO, leading to a substantial financial extraction from its treasury.

Understanding the Context

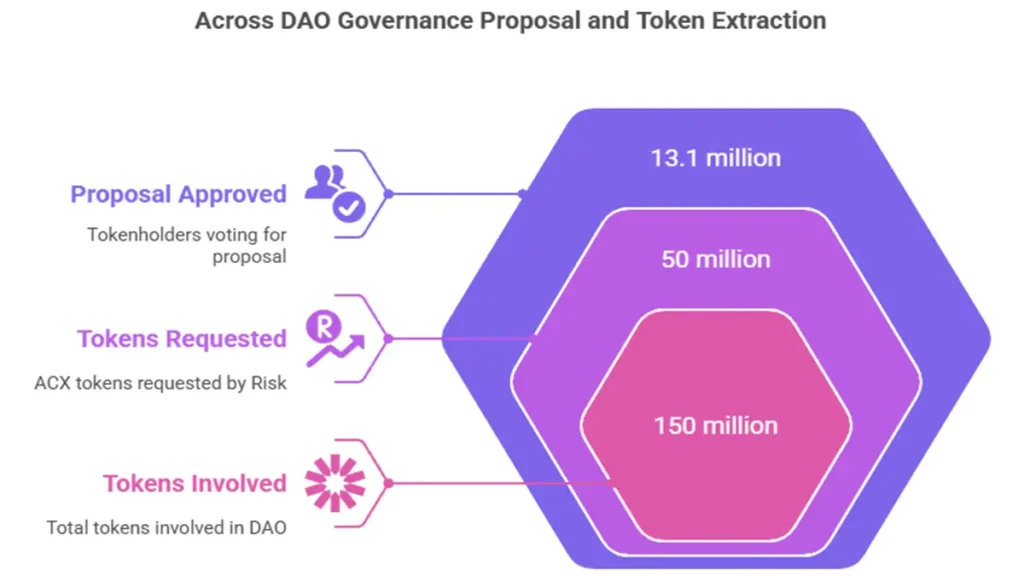

The first proposal in question was approved two years ago, securing an overwhelming 97% approval from token holders, representing a total voting power of approximately 13.1 million tokens. This initial success established a precedent for future proposals and set expectations for transparency and accountability within the DAO structure. Fast forward a year later, Risk Labs put forth a request for 50 million ACX tokens for “retroactive funding.” This proposal would ultimately become a focal point in allegations of vote manipulation.

The Allegations Unfold

According to Ogle’s assertions, if the team behind Risk Labs had abstained from voting on this second proposal, it would not have reached quorum—the minimum number of votes needed for the proposal to be valid. It raises significant questions about the motivations behind those votes and whether they were genuinely in service of the DAO’s interests or self-serving objectives.

Ogle’s analysis suggests that many members of the Risk Labs team covertly participated in approving this proposal. One striking detail is that the second-largest voting wallet in this governance exercise was initially funded by Hart Lambur, raising eyebrows about potential conflicts of interest and influence over community decisions.

Moreover, Ogle pointed out that there were no formal agreements stipulating how these funds would be utilized within Across, further muddying the waters regarding accountability and transparency. The lack of clear guidelines opens up discussions about trust in DAOs and highlights vulnerabilities in their governance frameworks.

The Financial Implications

As noted by Ogle, these manipulative tactics potentially enabled insiders to extract approximately $23 million from the DAO’s treasury at current market values. With ACX tokens experiencing a decline—around 9.3% loss in value over 24 hours—this case illustrates not only the financial stakes involved but also how market volatility can exacerbate existing tensions within DeFi ecosystems.

This situation underscores an essential reality: while DAOs are designed to empower users through collective decision-making, they are not immune to exploitation or manipulation by those who hold significant power or influence within these organizations.

Reflecting on Governance Challenges

The claims surrounding Across/Risk highlight critical challenges faced by DAOs today. As governance structures evolve, ensuring transparency, preventing conflicts of interest, and fostering genuine community engagement remain paramount to maintaining trust among participants. These allegations serve as a reminder that while decentralized systems offer innovative solutions for financial interaction and governance, they also require robust mechanisms to safeguard against potential abuses.

Risk Labs Denies Misuse Allegations

Risk Labs found itself at the center of controversy following allegations of misuse surrounding its token management practices. The founder, Lambur, has firmly denied these accusations, asserting that the claims are “categorically untrue.”

The crux of the controversy revolves around allegations suggesting that members of the Risk Labs team mismanaged their tokens in a manner that compromised the integrity of their decentralized autonomous organization (DAO). Critics have raised concerns about potential conflicts of interest and lack of transparency regarding voting practices. Given the importance of ethical governance in DAOs, these accusations have garnered significant attention from both supporters and detractors.

Lambur’s Response

In a detailed response to these allegations, Lambur clarified that Risk Labs’ token has been operational for nearly three years. He emphasized that team members are entitled to purchase tokens using their own funds, allowing them to participate in governance through voting on proposals—just as any other DAO member would. “My team is free to buy tokens and privately vote in proposals, just like every other DAO out there,” he stated confidently.

Lambur also addressed concerns regarding the addresses used for voting. He highlighted that these addresses are “publicly disclosed and publicly linked,” countering claims of secrecy. By affirming this level of transparency, he sought to reassure stakeholders about the integrity of Risk Labs’ operations.

Criticism of Accusers

Lambur did not shy away from criticizing those who brought forth the allegations. In particular, he directed his ire towards Ogle, questioning his credibility due to his anonymous status and potential connections to competing projects such as LayerZero and Stargate. Notably, Lambur pointed out that Bryan Pellegrino, founder of both LayerZero and Stargate, retweeted Ogle’s post shortly after it was published. This connection raises questions about possible motivations behind Ogle’s accusations and whether they stem from competitive rivalry rather than genuine concerns for governance.

The Broader Implications

This incident underscores a critical issue within the DeFi space: maintaining transparency while navigating competitive landscapes. As more individuals engage with DAOs and blockchain projects, ensuring ethical practices becomes increasingly vital. The ability for project leaders to address controversies effectively can significantly impact community trust and project sustainability.

For investors and community members alike, it is essential to critically evaluate claims made within this space. While scrutiny can lead to accountability, it is equally important to consider potential biases or conflicts of interest among accusers.

Conclusion: Navigating Trust in DeFi

The allegations against Across Protocol underscore an urgent need for vigilance within the DeFi space regarding governance practices. As decentralized systems continue to grow in popularity and complexity, maintaining transparency and accountability will be crucial in building trust among users and investors alike.

As we witness these developments unfold, it’s essential for participants in DeFi ecosystems—whether as investors or developers—to engage critically with governance structures and advocate for best practices that prioritize community interests over individual gains.

The situation involving Risk Labs serves as a reminder of the importance of transparency and accountability within the nonprofit sector. As potential donors and stakeholders become more discerning about where they allocate their resources, organizations must ensure they operate within ethical frameworks that foster trust and confidence.

As we continue to navigate these complexities in nonprofit classifications, it is imperative for stakeholders to advocate for clearer regulations and rigorous verification processes that can help distinguish legitimate nonprofits from those that may misrepresent their intentions. Best regards, Finance Mate Club