Understanding the Big Beautiful Bill: What It Means for Your Family’s Finances

The passage of the legislation dubbed the “One Big Beautiful Bill” has stirred significant debate across the nation, especially among families who are keenly aware of how such policies can impact their everyday lives. While the White House touts this bill as a monumental step toward middle-class relief, critics warn of far-reaching consequences that could affect vital services for millions. As a parent, understanding the nuances of this bill is essential for navigating your family’s financial future. Here are five crucial aspects every parent should know.

The Promises of the Big Beautiful Bill

White House Press Secretary Karoline Leavitt heralded the bill as a triumph for nearly 80 million Americans, claiming it delivers on a “common sense agenda.” Central to this narrative are several key components:

- Largest Middle-Class Tax Cut in History: Advocates argue that the bill will significantly reduce taxes for middle-class families, providing them with more disposable income. This could translate into increased spending power, helping families save for future needs or invest in their children’s education.

- Permanent Border Security: The bill includes substantial allocations for border security, which supporters claim is essential for national safety and economic stability. Proponents believe that secure borders can lead to better job opportunities and reduced illegal immigration, fostering a more robust economy.

- Massive Military Funding: Increased military funding is presented as a measure to ensure national defense and job creation within defense sectors. Supporters argue that this investment will ultimately benefit families through job stability and economic growth.

- Restoration of Fiscal Sanity: The administration claims that the legislation will restore fiscal discipline by curbing excessive government spending. However, critics argue that the proposed cuts to social programs may undermine this claim.

The Critics’ Concerns

Despite the optimistic portrayal by supporters, many economists and analysts have raised serious concerns regarding the bill’s implications:

- Cuts to Medicaid: Economic Policy Institute President Heidi Shierholz describes the legislation as potentially “one of the most destructive economic bills in generations.” One of the primary concerns is its significant cuts to Medicaid—a lifeline for millions of low-income families who depend on it for health care services.

- Slashing Food Aid: The bill’s approach to reducing food aid programs raises alarms among advocates for low-income families who rely on these benefits for basic nutrition. Critics argue that such cuts could push many families deeper into poverty and food insecurity.

- Impact on Rural Hospitals: Many rural hospitals may face closure due to reduced funding from Medicaid cuts, leading to decreased access to essential health services in underserved areas. This situation could disproportionately affect families living outside urban centers, where healthcare options are already limited.

- Tax Cuts Favoring the Wealthy: Detractors assert that while middle-class families may see some tax relief, much of the financial benefit is skewed toward wealthier individuals and corporations. This raises questions about fairness and equity within the tax structure.

- Changes in College Funding: The legislation also proposes alterations in college funding mechanisms, which could impact financial aid availability for students from low- and middle-income families—making higher education less accessible.

Explore how the Act impacts family finances and what parents need to know

Here are five crucial aspects every parent should know.

1. The Child Tax Credit Increases

In recent years, financial support for families has become a critical topic in public discourse, particularly as economic challenges persist. One of the key components of this support is the federal Child Tax Credit (CTC), which provides essential financial assistance to families with children. The recently proposed One Big Beautiful Bill Act (OBBBA) brings significant changes to this credit, enhancing its benefits and extending its reach.

What is the Child Tax Credit?

The Child Tax Credit is a federal program designed to help families with qualifying children under the age of 17 who possess a valid Social Security number. Historically, this credit has provided crucial financial relief, but the OBBBA proposes an increase in its value starting from the 2025 tax year. Currently set at $2,000 per child, the credit will rise to $2,200. Additionally, the refundable portion—the amount that families can receive back even if they do not owe taxes—will increase from $1,600 to $1,700.

Key Provisions of the OBBBA

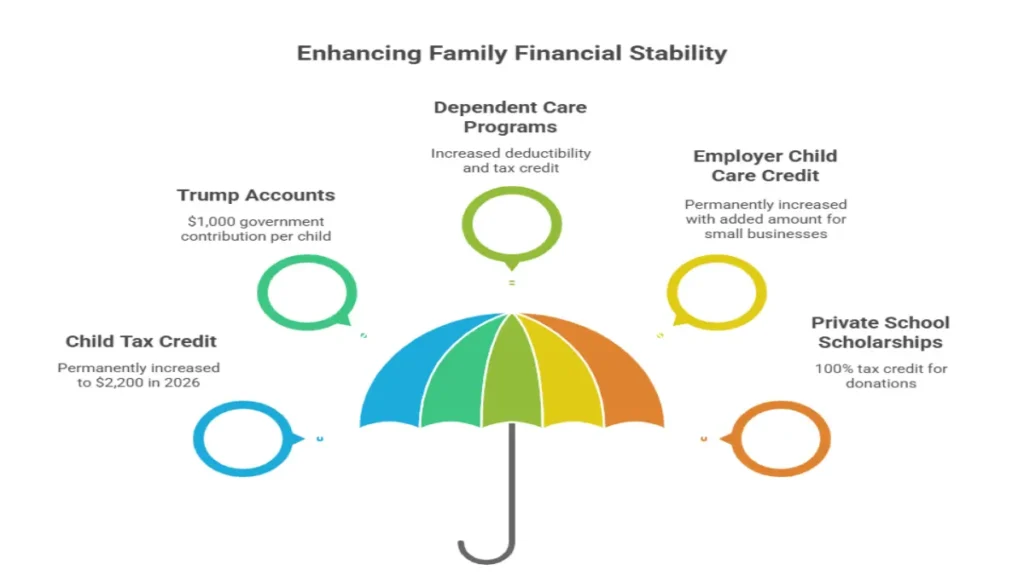

The OBBBA introduces several important provisions aimed at bolstering family financial stability. Here’s a closer look at some of these enhancements:

Enhancing Financial Support for Families

The increase in the Child Tax Credit under OBBBA is not just a nominal change; it represents a substantial commitment to supporting families as they navigate rising costs associated with raising children. The permanent increase to $2,200 starting in 2026 allows families greater flexibility in budgeting for necessities such as education and healthcare.

Moreover, initiatives like Trump Accounts introduce an innovative savings mechanism where the government contributes $1,000 per child born between 2025 and 2028. Parents can also contribute up to $5,000 annually. This approach encourages saving for children’s futures while simultaneously easing immediate financial pressures.

Supporting Childcare Costs

Another vital aspect of OBBBA is its focus on childcare expenses. The maximum annual amount deductible from income for dependent care assistance programs will rise significantly—from $5,000 to $7,500—making it easier for parents to afford quality childcare services without straining their finances.

Additionally, increasing the child and dependent care tax credit rate from 35% to 50% empowers families by making childcare more affordable. This change can lead to substantial savings on taxes owed and promote workforce participation among parents who may have previously found childcare costs prohibitive.

Investing in Education

The OBBBA also addresses educational support through private school scholarships. A remarkable feature of this act is that it offers a full tax credit for donations made to organizations providing private school scholarships. This initiative not only incentivizes contributions but also enhances educational opportunities for families seeking alternative schooling options.

2. Medicaid Cuts That Impact Families

In recent discussions surrounding changes to the American healthcare system, the focus has shifted significantly towards the implications of proposed Medicaid cuts. Critics, including Steven Rattner, a former counselor to the Treasury Secretary during the Obama administration, have raised alarms about what these adjustments mean for vulnerable families across the nation. As we delve deeper into the nuances of this issue, it becomes evident that these cuts could have far-reaching consequences, particularly for those who rely on Medicaid for essential health services.

Understanding Medicaid and Its Importance

Medicaid serves as a crucial safety net for millions of Americans, providing health coverage to low-income individuals and families, including children, pregnant women, elderly individuals, and people with disabilities. For many, it is more than just insurance; it is a lifeline that ensures access to necessary medical care, preventive services, and mental health support. Given its pivotal role in public health, any changes to its structure warrant serious scrutiny.

The New Work Requirements

Starting in late 2026, significant alterations will be introduced to the Medicaid program. One of the most contentious changes is the implementation of new work requirements for adults enrolled in Medicaid. Specifically, beneficiaries will be expected to complete 80 hours of work per month—a mandate that extends even to parents with children aged 14 and older. While proponents argue that such measures encourage personal responsibility and economic self-sufficiency, critics contend that they could endanger access to vital healthcare services for millions.

The implications are stark: individuals who fail to meet these requirements or cannot furnish appropriate documentation risk losing their Medicaid coverage altogether. According to estimates from the nonpartisan Congressional Budget Office (CBO), as many as 16 million people could find themselves without access to Medicaid, the Children’s Health Insurance Program (CHIP), or Affordable Care Act (Obamacare) exchanges over the next decade.

Potential Consequences for Families

The introduction of work requirements poses several challenges for families who depend on Medicaid. For many low-income workers, maintaining stable employment can be an uphill battle due to factors such as job availability, childcare responsibilities, transportation issues, and health-related obstacles. Missing paperwork or failing to meet hour requirements can lead not only to loss of coverage but also increased financial strain from medical bills.

Moreover, these cuts may disproportionately affect single-parent households and marginalized communities already facing systemic barriers. The potential increase in uninsured rates among children is particularly concerning since access to healthcare during formative years is critical for long-term health outcomes.

An Urgent Call for Dialogue

As we consider these impending changes to Medicaid, it is essential for policymakers and community advocates to engage in meaningful dialogue about how best to support vulnerable populations while ensuring accountability within welfare programs. Balancing fiscal responsibility with compassion should be at the forefront of discussions regarding healthcare reform.

The proposed cuts raise fundamental questions about our collective values as a society—do we prioritize economic indicators over human well-being? Are we willing to sacrifice access to healthcare for those who need it most? As concerned citizens and stakeholders in this conversation, we must advocate for policies that promote inclusivity rather than exclusion.

3. Newborns Get $1,000 Investment Accounts

In an exciting development set to launch between 2025 and 2028, the U.S. government will introduce a groundbreaking initiative aimed at enhancing the financial security of the nation’s youth. Every child born to a parent with a Social Security number will receive a “Trump account,” an investment account funded with an initial deposit of $1,000 at birth. This innovative program is designed not just as a gift but as a stepping stone towards financial literacy and independence for future generations.

Understanding the Trump Account

The Trump account, while inspired by traditional individual retirement accounts (IRAs), features several significant distinctions that cater specifically to newborns and their financial futures. Firstly, unlike standard IRAs that require contributions from earned income, these accounts allow for contributions regardless of the child’s age or income status—an important feature considering that these accounts are established at birth.

Furthermore, one of the most attractive aspects of this initiative is that beneficiaries can access their funds at the age of 18. This provides young adults with a valuable financial resource when they may need it most—whether to fund higher education, start a business, or invest in their first home. Traditional IRAs typically impose penalties for early withdrawals until individuals reach retirement age, making the Trump account a more flexible option for young investors.

Contribution Limits and Employer Involvement

The program also establishes specific contribution limits to ensure its sustainability and effectiveness. Annual contributions to the Trump account are capped at $5,000. However, there’s an additional opportunity for employers to contribute up to $2,500 tax-free to each child’s account—a potential game changer for families looking to bolster their children’s financial foundation.

This dual contribution structure not only encourages parents and guardians to actively invest in their children’s futures but also incentivizes employers to participate in fostering financial wellness among their workforce.

Opening Accounts for Older Children

It’s worth noting that even children born before 2025 will have the opportunity to open these accounts; however, they will not receive the initial $1,000 starter money unless they are born during the designated timeframe. This provision ensures inclusivity while acknowledging those who may have missed out on earlier initiatives aimed at promoting financial literacy.

Implications for Families and Society

The introduction of Trump accounts could have profound implications on family dynamics and societal attitudes towards savings and investments. By instilling a culture of investment from such a young age, parents can foster discussions around money management, savings strategies, and investment principles in their households.

Moreover, this initiative aligns with broader trends towards financial education in schools and communities, ultimately aiming to create financially savvy citizens who are better prepared to navigate economic challenges as adults.

4. Your Kid’s College Costs Are Likely To Go Up

As parents, the dream of sending our children to college is often paired with the hope that higher education will pave the way for a prosperous future. However, recent changes in federal student loan policies have introduced a harsh new reality for families—especially those with older children preparing for college. With significant cuts to borrowing limits and repayment options, many families may find themselves grappling with increased costs that could make college less accessible than ever before.

The Impact of the One Big Beautiful Bill Act on Student Loan Borrowers

In recent years, student loan reform has been a hot topic, particularly as millions of borrowers navigate the complexities of repayment options. The One Big Beautiful Bill Act (OBBBA) represents a significant shift in how federal student loans are structured and managed, impacting various borrower demographics in profound ways.

Understanding the OBBBA Changes

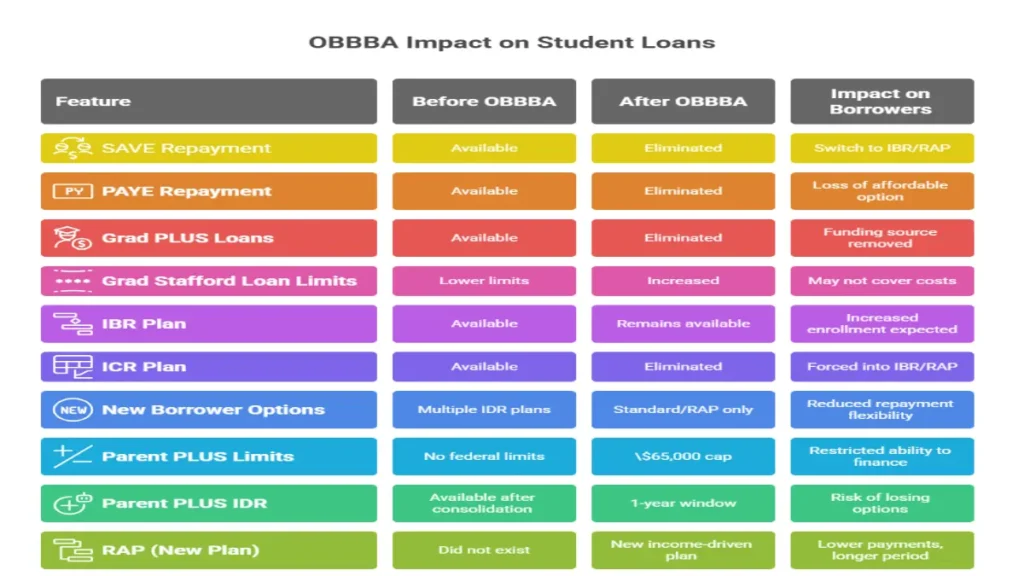

The OBBBA introduces several modifications to existing student loan programs, fundamentally altering repayment plans, borrowing limits, and eligibility criteria. Below is a detailed analysis of the primary features affected by the act.

Key Changes Explained

- Elimination of Popular Plans: The most significant change is the elimination of popular repayment plans like SAVE and PAYE. These programs offered vital pathways to loan forgiveness and manageable payments based on income. With their removal, many borrowers will face higher payments and less flexibility in managing their debts.

- New Loan Structures: Graduate PLUS loans have been completely eliminated under the new legislation. This change marks a drastic reduction in financial support for those pursuing advanced degrees. Additionally, while limits on Graduate Stafford Loans have increased substantially, they may still not cover the entire costs associated with expensive professional programs.

- Shifts in Repayment Options: The current landscape now primarily relies on Income-Based Repayment (IBR) and a newly introduced Repayment Assistance Plan (RAP). While IBR remains a viable option, RAP requires borrowers to wait significantly longer—30 years—before qualifying for forgiveness.

- Impact on Parents: Parents hoping to finance their children’s education through Parent PLUS loans will find themselves facing a lifetime borrowing cap of $65,000—a substantial decrease from previous policies where there were no federal limits on borrowing.

- Long-Term Consequences: The changes implemented by the OBBBA not only affect current borrowers but also pose challenges for future students seeking financial aid. With reduced options and stricter limits on borrowing, students may have to reconsider their educational paths or seek alternative financing methods.

Understanding the Changes

The most notable change is perhaps the introduction of borrowing caps on Graduate PLUS Loans and Parent PLUS loans. Where families previously enjoyed more flexible borrowing amounts, they are now faced with strict limits that could hinder their ability to fully finance higher education. For graduate students, losing unlimited borrowing means that many may need to reconsider their choices regarding advanced degrees.

Additionally, the elimination of various income-driven repayment plans such as PAYE and ICR further complicates matters for borrowers. These plans provided essential pathways toward manageable debt repayment; their removal could lead to financial strain as families try to navigate new options that lack flexibility.

The Broader Implications

The implications extend beyond just numbers. As college costs continue to rise—outpacing inflation and wage growth—the reduced borrowing capacity could lead many families to rethink their educational goals. A student who once aspired to attend a prestigious university might now settle for a less expensive option simply due to financial constraints.

Moreover, this shift in policy could exacerbate existing inequalities in access to higher education. Families who can afford upfront costs may still pursue elite institutions, while those dependent on federal loans face potential barriers that could deter them from applying at all.

5. A New National School Choice Program

Starting in 2027, the landscape of educational funding in the United States is set to undergo a significant transformation with the introduction of a new national school choice program. This initiative will see the federal government providing tax credits to individuals who contribute to private school scholarship funds, effectively creating a national school voucher program. With donors eligible for 100% tax credits on contributions up to $1,700, families will gain increased access to private education options.

Understanding the New School Choice Program

At its core, this new initiative aims to expand educational opportunities for families by incentivizing donations to private school scholarship funds. By offering a tax credit equivalent to the donation amount, the federal government hopes to encourage more individuals and organizations to contribute financially. The resulting funds will then be allocated as scholarships for families wishing to enroll their children in private schools.

This approach not only increases funding for private education but also introduces competition into the schooling system. Proponents argue that competition can lead to improvements in both public and private schools as they strive to attract students through enhanced programs and better outcomes.

Potential Benefits

Increased Educational Options

One of the primary advantages of this program is that it broadens educational choices for families. Many parents may feel limited by their local public schools due to various factors such as inadequate resources or unsatisfactory performance. The new tax credit system allows these families greater flexibility in selecting schools that align with their educational values and aspirations for their children.

Financial Relief for Families

For many families, affording private school tuition can be a significant financial burden. The scholarship funds created through donor contributions will help alleviate some of these costs, making it feasible for more students to attend private institutions without imposing an overwhelming financial strain on their families.

Encouraging Community Involvement

The program also aims to foster community involvement in education by motivating individuals and businesses to invest in local schools. When community members contribute financially, they are likely to take a vested interest in the quality of education provided within their neighborhoods, potentially leading to stronger partnerships between schools and local organizations.

Challenges and Considerations

While there are numerous potential benefits associated with this new school choice program, it is essential also to consider its challenges and criticisms.

Impact on Public Schools

One major concern is how this initiative may affect funding for public schools. As more funds are diverted toward private school scholarships, public institutions might experience decreased financial support. This could exacerbate existing inequities within the education system if not managed carefully.

Access and Equity Issues

Another point of contention revolves around access and equity. Critics argue that while tax credits can benefit wealthier families who have more disposable income to donate, lower-income families may find themselves unable to participate fully in this system. Ensuring equitable access remains a critical consideration as policymakers implement this program.

Conclusion

The One Big Beautiful Bill stands as a complex piece of legislation with both potential benefits and considerable drawbacks for American families. By understanding these five key areas—Child Tax Credit increases, Medicaid cuts, investment accounts for newborns, rising college costs, and school choice options—parents can better navigate the changes ahead and advocate effectively for their children’s needs.

As we move forward in this evolving landscape of policy changes, staying informed is paramount. Consider discussing these issues with your family or local community representatives to voice your concerns and ensure your family’s needs are met amid shifting political tides. Best regards, Finance Mate Club