Ethereum ETFs and Their Fees, Promotions and Holdings All you need

The world of cryptocurrency continues to evolve, and one of the latest developments is the introduction of spot Ethereum exchange-traded funds (ETFs). Approved by the U.S. Securities and Exchange Commission (SEC) on July 23, 2024, these ETFs mark a significant milestone in the cryptocurrency investment landscape. As investors seek new avenues to engage with digital assets, understanding what spot Ethereum ETFs are and how they differ from previous investment products is essential.

What is a Spot Ethereum ETF?

A spot Ethereum ETF is an investment vehicle that directly purchases and holds Ethereum, which is the second-largest cryptocurrency by market capitalization following Bitcoin. Unlike other financial instruments that may involve derivatives or futures contracts, a spot ETF allows investors to gain exposure to the actual asset—Ethereum itself. This direct connection means that the price of a spot Ethereum ETF closely mirrors the fluctuations of Ether’s market value.

The Significance of the July 2024 Approval

The SEC’s approval of spot Ethereum ETFs follows its earlier endorsement of spot Bitcoin ETFs in January 2024. This sequential approval highlights an increasing regulatory acceptance of cryptocurrency as a legitimate investment class. For investors and financial institutions alike, these products offer an easier entry point into the volatile world of cryptocurrencies without needing to manage wallets or security measures associated with owning digital currencies directly.

Distinguishing Features of Ethereum

Ethereum stands apart from Bitcoin due to its multi-faceted capabilities beyond just a digital currency. Its blockchain supports decentralized applications (dApps) and non-fungible tokens (NFTs), making it a versatile platform for innovation in various sectors such as finance, gaming, and art. Furthermore, since its transition to a proof-of-stake system in 2022, Ethereum has adopted a more energy-efficient method for generating new coins compared to Bitcoin’s proof-of-work mining process. This shift not only enhances sustainability but also aligns with growing global concerns about energy consumption in cryptocurrency mining.

Comparing Spot ETFs with Strategy ETFs

Before the launch of spot Ethereum ETFs, investors had access to Ethereum strategy ETFs that utilized futures contracts to speculate on Ether’s price movements. While these strategy ETFs provided some exposure to Ethereum’s performance, they often fell short in accurately tracking its price due to factors like contango and backwardation inherent in futures markets. Additionally, these products typically come with higher fees compared to their spot counterparts.

With the introduction of spot ETFs, investors can expect more precise tracking of Ether’s market value without incurring unnecessary costs associated with futures trading. This clarity could attract a broader range of institutional and retail investors looking for straightforward ways to invest in cryptocurrencies.

The Current Landscape: Eight Spot Ethereum ETFs

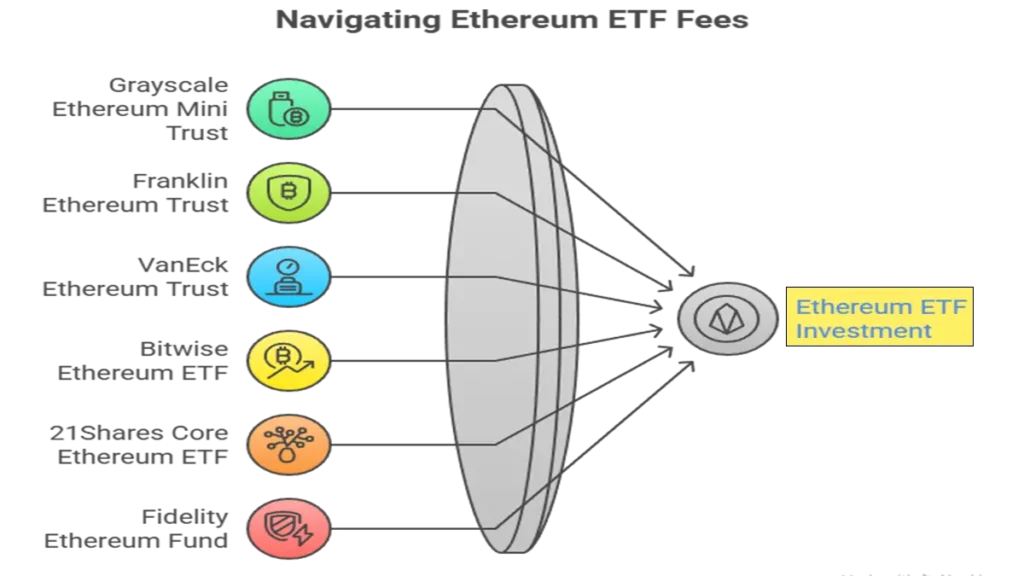

Here’s a look at the nine spot Ethereum ETFs currently trading, along with their fee structures and any promotional waivers that may apply:

.. Grayscale Ethereum Mini Trust (ETH)

- Fee: 0.15%

- Notes: N/A

.. Franklin Ethereum Trust (EZET)

- Fee: 0.19%

- Notes: N/A

.. VanEck Ethereum Trust (ETHV)

- Fee: 0.20%

- Notes: Fee waived until July 22, 2025, or until the fund reaches $1.5 billion in assets.

.. Bitwise Ethereum ETF (ETHW)

- Fee: 0.20%

- Notes: N/A

.. 21Shares Core Ethereum ETF (CETH)

- Fee: 0.21%

- Notes: N/A

.. Fidelity Ethereum Fund (FETH)

- Fee: 0.25%

- Notes: N/A

.. iShares Ethereum Trust (ETHA)

- Fee: 0.25%

- Notes: Reduced to 0.12% until July 23, 2025, or until the fund reaches $2.5 billion in assets.

.. Invesco Galaxy Ethereum ETF (QETH)

- Fee: 0.25%

- Notes: N/A

.. Grayscale Ethereum Trust (ETHE)

- Fee: 2.50%

- Notes: N/A

Analyzing Fees and Promotions

When considering an investment in these funds, fees play a critical role in determining overall returns. The fees for these spot Ethereum ETFs range from a modest 0.15% for Grayscale’s Mini Trust to a steep 2.50% for Grayscale’s larger trust (ETHE). Notably, several funds are offering promotional fee waivers designed to attract early investors—most prominently VanEck and iShares—making them potentially more appealing options in the current market environment.

The Importance of Diversification

Investing in spot ETH through these ETFs provides an efficient way for both retail and institutional investors to diversify their portfolios without the complexities involved in direct cryptocurrency trading or storage solutions such as digital wallets and exchanges.

Furthermore, as more traditional financial institutions embrace cryptocurrencies by offering products like these ETFs, it lends legitimacy to the asset class itself and may encourage even broader participation from mainstream investors.

The Competitive Landscape of Ethereum ETFs

As multiple issuers rushed to secure their position in the burgeoning market for Ethereum ETFs, many took aggressive steps to differentiate themselves from their competitors. The primary battleground? Fees. In an environment where margins are thin and investor interest is at an all-time high, issuers engaged in a strategic game of undercutting one another. This involved filing amended registration statements that lowered fees and announcing promotional offers that could sway potential investors.

For instance, some firms drastically reduced their management fees, while others went so far as to offer zero fees for the first six months of trading. This frenzy of last-minute adjustments created a dynamic atmosphere where fee structures were frequently changing, leading to confusion among potential investors who needed clarity on which ETF would ultimately be the most cost-effective choice.

Implications for Investors

The rapid changes in fee structures underscore the importance of vigilance when it comes to investing in Ethereum ETFs. Investors must be wary of relying on outdated information found online regarding fees and promotional offers. What may have been true just hours ago could have changed dramatically by the time they make their investment decision.

Moreover, while lower fees are undoubtedly attractive, it’s crucial for investors to consider other factors such as fund performance, liquidity, and overall reputation of the issuer. A thorough analysis will provide a more comprehensive understanding of each ETF’s value proposition beyond just its fee structure.

The Future of Ethereum ETFs

As we move forward from this initial wave of competition, it remains to be seen whether these pricing strategies will stabilize or continue to evolve. If history is any guide, we can expect further innovations in fee structures and perhaps even new offerings that cater specifically to niche investor segments or particular trading strategies.

The SEC’s approval marks a new chapter not only for Ethereum but also for how traditional finance interacts with cryptocurrency markets. As institutional interest continues to grow, monitoring these developments will be vital for anyone looking to invest in this space.

Ethereum Strategy ETFs: A New Era for Crypto Investment

In the ever-evolving landscape of cryptocurrency investment, Exchange-Traded Funds (ETFs) have emerged as a pivotal vehicle for both seasoned and novice investors. Among the myriad of options available, Ethereum strategy ETFs—specifically those that invest at least 50% of their assets in Ether futures—are capturing significant attention. With four notable funds currently on the market.

The Current Landscape of Ethereum Strategy ETFs

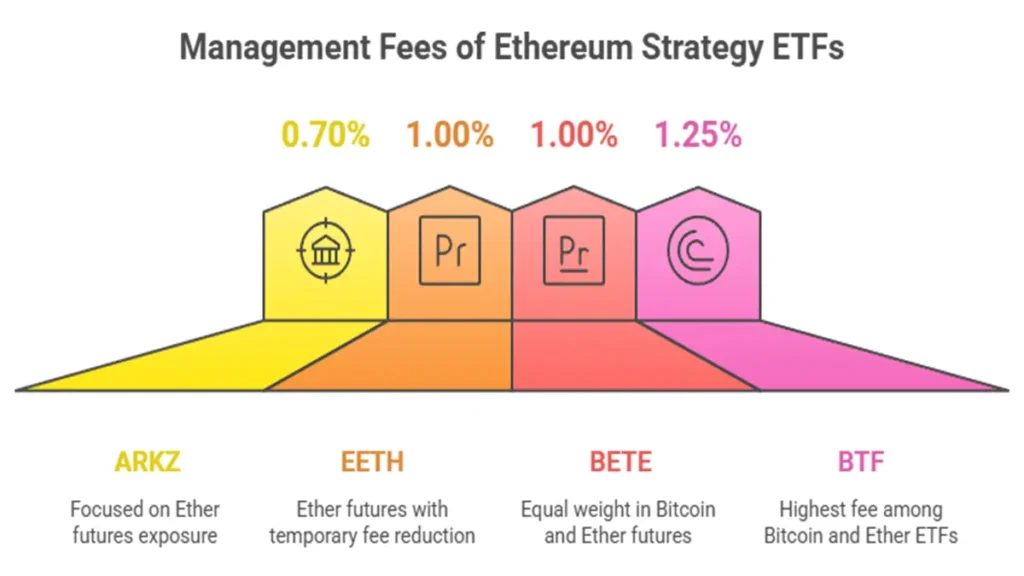

As of now, there are four prominent Ethereum strategy ETFs available to investors. Listed from lowest to highest fee, they include:

- ARK 21Shares Active Ethereum Futures Strategy ETF (ARKZ) – 0.70% Fee

This fund is exclusively invested in Ether futures, providing a focused approach for those looking to gain exposure to Ethereum’s price movements. - ProShares Ether Strategy ETF (EETH) – 1.00% Fee

Similar to ARKZ, EETH invests solely in Ether futures but has an introductory fee reduction to 0.95%, which will last until September 30, 2025. - ProShares Bitcoin & Ether Equal Weight Strategy ETF (BETE) – 1.00% Fee

Offering a balanced approach, BETE invests equally in Bitcoin and Ether futures, giving investors diversified exposure to two leading cryptocurrencies while also enjoying the same temporary fee reduction as EETH. - CoinShares Valkyrie Bitcoin and Ether Strategy ETF (BTF) – 1.25% Fee

This fund invests in both Bitcoin and Ether futures but comes with the highest management fee among its peers.

What Do ETF Approvals Mean for Ethereum?

The approval of these Ethereum ETFs marks a significant milestone in the cryptocurrency space, particularly as it opens up new avenues for institutional and retail investors alike. For instance, Americans collectively hold nearly $40 trillion in retirement accounts; many of these accounts do not permit direct trading of cryptocurrencies like Ethereum. Therefore, these newly approved ETFs provide a much-needed gateway for investors seeking exposure to crypto assets within their retirement portfolios.

However, it’s worth noting that the market’s immediate response was somewhat subdued. On July 23—the first trading day for these ETFs—the price of Ether actually experienced a slight decline during market hours. This muted reaction raises questions about whether ETF approvals will indeed fuel momentum for the second-largest cryptocurrency by market capitalization.

Comparing Ethereum ETFs to Direct Investment

While Ethereum strategy ETFs present a convenient option for many investors—especially those unable or unwilling to buy cryptocurrencies directly—they also come with certain drawbacks compared to owning Ether itself.

One notable advantage is accessibility; spot Ethereum ETFs may offer a more cost-effective and straightforward means for retirement account holders to invest in crypto without the complexities involved in purchasing and securing digital assets directly.

On the flip side, one significant disadvantage is that investors in these funds will not earn staking rewards—essentially interest payments or dividends provided to holders of Ether who participate in network validation processes through staking. This potential income stream is one reason why some investors still prefer direct ownership over ETF investments.

Conclusion: A New Frontier for Investors

The arrival of spot Ethereum ETFs is more than just another investment option; it represents a shift towards mainstream acceptance of cryptocurrencies within regulated financial markets. As these innovative products become available, they promise to simplify access for investors while potentially enhancing liquidity and stability in the crypto market.

Ultimately, whether you choose an ETF or opt for direct investment will depend on your financial goals, risk tolerance, and investment strategies. As always, thorough research and consideration are essential before making any investment decisions. Best regards, Finance Mate Club