ase Studies: Real-Life Examples of Credit Scores and Debt Consolidation Savings

Debt consolidation is a popular strategy for managing financial obligations, combining multiple debts into a single loan, ideally with a lower interest rate. However, the success of this strategy hinges on one crucial factor: your credit score. A high credit score opens the door to better loan offers and lower interest rates, which can translate into thousands of dollars in savings.

Let’s explore this concept further through two real-life case studies that illustrate how your credit score can be the key to financial freedom.

The Role of Your Credit Score

Your credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. Lenders use this score to assess the risk associated with lending you money. A higher credit score indicates responsible credit behavior and suggests that you are less likely to default on loans, thus qualifying you for lower interest rates. Conversely, a lower credit score may lead to higher interest rates or even denial of loan applications.

Interest Rates and Potential Savings

The interest rate attached to your debt consolidation loan plays a pivotal role in determining your potential savings. For those with high credit scores (typically above 700), lenders often offer attractive rates that can result in significant monthly savings and overall reduced repayment amounts. For example, if you consolidate $20,000 in high-interest debt at an interest rate of 6% instead of 18%, you could save thousands in interest payments over the life of the loan.

On the other hand, individuals with lower credit scores may find themselves facing higher interest rates—sometimes exceeding 20%. In such cases, the cost of borrowing may negate any benefits from consolidating debts. If the new rate is not considerably lower than what you currently pay, consolidating may not only fail to save you money but could also extend the repayment period and increase total debt.

The Importance of Improving Your Credit Score

Given the direct correlation between your credit score and interest rates for debt consolidation loans, improving your credit score before applying can be a game-changer. Here are several strategies to enhance your credit profile:

- Pay Your Bills on Time: Late payments can significantly damage your credit score. Setting up automatic payments or reminders can help ensure you never miss a due date.

- Reduce Credit Utilization: Aim to use no more than 30% of your available credit limit across all accounts. Paying down existing balances can improve this ratio.

- Avoid New Hard Inquiries: Each time you apply for new credit, it can cause a temporary dip in your score due to hard inquiries on your report. Limit new applications while working to boost your score.

- Check Your Credit Report: Regularly reviewing your credit report for errors or fraudulent activity can help maintain accuracy and prevent unnecessary drops in your score.

By implementing these strategies, you can potentially elevate your credit standing over time and position yourself favorably when applying for debt consolidation loans.

Real-life case studies

Real-life case studies that illustrate how effective debt consolidation strategies can lead to significant savings and improved credit scores, thereby enhancing overall financial health.

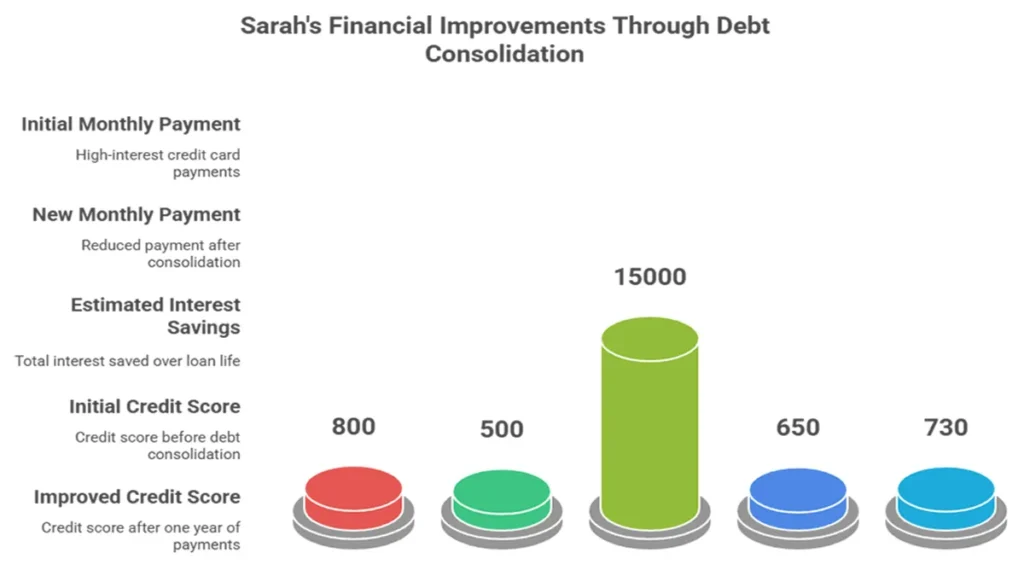

Case Study 1: Sarah’s Journey to Financial Freedom

Sarah, a 35-year-old marketing professional, found herself burdened by $30,000 in high-interest credit card debt. With an average interest rate of 20%, her monthly payments consumed a significant portion of her income. After researching options for debt relief, Sarah decided to consolidate her debts through a personal loan with a local bank at an interest rate of 10%.

By consolidating her debts into this single loan with lower interest rates, Sarah reduced her monthly payment from $800 to $500. Over the life of the loan, she estimated that she would save approximately $15,000 in interest payments alone. Additionally, as she consistently made on-time payments on her new consolidated loan, her credit score improved from 650 to 730 within just one year. This increase allowed Sarah to qualify for better mortgage rates when she decided to purchase her first home.

Case Study 2: Mark’s Effective Strategy

Mark was a 28-year-old graduate student struggling with $25,000 in student loans and $10,000 in personal loans from various sources. The cumulative interest on these loans was exacerbating his financial strain. After consulting with a financial advisor, Mark opted for a debt management plan (DMP) that helped him negotiate lower interest rates with his creditors.

Through the DMP, Mark managed to consolidate his total debt into one monthly payment of $400 at an average interest rate of 6%. This change not only made his budget more manageable but also facilitated timely payments. Over three years, he saved around $4,500 in interest payments compared to his previous arrangements. Moreover, as he consistently paid off his debts through the DMP program, Mark saw his credit score rise from 620 to 720—a significant improvement that opened doors for better financing options post-graduation.

Conclusion: Making Informed Financial Decisions

Your credit score is more than just a number; it’s a vital component that influences your financial opportunities and obligations. When considering debt consolidation as a method to alleviate financial burdens, understanding how your credit score affects the terms and conditions of the loans available to you is paramount.

If you’re contemplating debt consolidation, take the time to assess and improve your credit score before proceeding with an application. Not only will this increase your chances of securing favorable rates, but it will also maximize potential savings—transforming what could be an overwhelming financial situation into a manageable plan for recovery.

Call to Action

Are you ready to take control of your finances? Start by checking your current credit score today and explore ways to enhance it before pursuing debt consolidation options. For more insights on managing debts effectively or tips on improving financial literacy. Best regards, Finance Mate Club