Getting Started with Cash App: Investing in Stocks and Bitcoin

In recent years, mobile payment apps have revolutionized the way we manage our finances. One such app that has garnered significant attention is Cash App, which not only facilitates peer-to-peer money transfers but also offers users the ability to invest in stocks and cryptocurrencies like Bitcoin. This blog post will guide you through the essentials of getting started with Cash App for investing, ensuring you have a clear understanding of its functionalities and benefits.

Understanding Cash App’s Features

Cash App, developed by Square Inc., is designed to simplify financial transactions for users. Its user-friendly interface makes it easy to send and receive money, but its investment features set it apart from other payment apps. Within Cash App, users can buy stocks and Bitcoin without needing a separate brokerage account. The integration of these investment options allows users to manage their finances more efficiently from a single platform.

Investing in Stocks

Cash App Investing is an extension of the popular peer-to-peer payment service, Cash App. Designed primarily for simplicity, this platform allows users to buy, sell, and trade stocks with ease. One of its standout features is the ability to purchase fractional shares. This means that even if you don’t have enough funds to buy a whole share of a company, you can still invest in that company by purchasing a fraction of a share. This capability is especially beneficial for beginners who may not have significant capital but want to start investing in high-value stocks.

Investment Options: Stocks, ETFs, and Bitcoin

Cash App Investing offers three primary investment options: stocks, exchange-traded funds (ETFs), and Bitcoin. While this selection may seem limited compared to larger brokerages, it covers essential bases for those just starting out in investing.

- Stocks: Users can directly invest in individual companies across various sectors. This is ideal for investors looking to take positions in specific companies they believe will grow over time.

- Exchange-Traded Funds (ETFs): For those who prefer diversification without having to pick individual stocks, ETFs provide an excellent avenue. These funds pool money from multiple investors to buy a collection of stocks or other securities, offering built-in diversification.

- Bitcoin: The inclusion of Bitcoin allows users to dip their toes into cryptocurrency investment—an increasingly popular asset class that can complement traditional investments.

Ease of Use and Low Fees

One of the major attractions of Cash App Investing is its low fee structure. There are no commission fees for buying or selling stocks or ETFs, which means your entire investment goes towards your chosen assets rather than being eaten away by transaction costs. This makes it particularly appealing for beginners who may be cautious about incurring additional expenses while learning the ropes.

The platform’s design is intuitive and straightforward, ensuring that users can easily navigate through their investment options without feeling overwhelmed by complex tools or jargon.

Limitations: Research Tools and Resources

While Cash App Investing excels in simplicity and accessibility, it does come with some limitations—most notably in its research capabilities. The platform provides very basic research tools; once you create your account, you’ll have access to features like “My First Stock,” but comprehensive analytical tools are conspicuously absent.

For more seasoned investors or those looking for detailed analysis before making investment decisions, this lack of depth could be a drawback. Nevertheless, beginner investors might find this rudimentary approach beneficial as it encourages them not to overthink their initial investments.

Investing in Bitcoin

Alongside traditional stocks, Cash App also supports Bitcoin trading, making it accessible for those interested in cryptocurrency investments.

- Buying Bitcoin: To purchase Bitcoin on Cash App, navigate to the “Bitcoin” tab within the app. You can choose how much Bitcoin you want to buy or specify an amount in dollars that you’d like to invest.

- Understanding Fees: It’s important to be aware of transaction fees associated with buying Bitcoin through Cash App. While these fees are generally lower than those charged by many cryptocurrency exchanges, they can vary based on market conditions.

- Storing Bitcoin: After purchasing Bitcoin, it is stored securely within your Cash App account. However, if you’re planning on holding a significant amount of cryptocurrency or trading frequently, consider transferring your assets to a dedicated cryptocurrency wallet for enhanced security.

Why People Love Using Cash App to Buy Bitcoin

1. Start with Just $1

One of the most appealing aspects of Cash App is its accessibility. Users can start investing in Bitcoin with as little as $1. This low entry barrier enables individuals who may be hesitant to invest large sums to dip their toes into the cryptocurrency market without financial strain. It democratizes access to Bitcoin, allowing more people to participate in this burgeoning financial ecosystem.

2. User-Friendly Interface

Cash App is designed with simplicity in mind, making it easy for anyone—regardless of their technical background—to navigate the app effectively. The straightforward layout allows users to buy, sell, and transfer Bitcoin seamlessly. For those who are new to cryptocurrencies, this ease of use can significantly reduce the intimidation factor often associated with digital asset transactions.

3. Send Bitcoin to Other Wallets or Friends

Cash App not only allows you to buy Bitcoin but also enables you to send it easily to other wallets or friends within the app. This feature promotes a sense of community and enhances social interactions around cryptocurrency trading. Whether you want to share your investment experience with friends or send Bitcoin as a gift, Cash App facilitates these transactions effortlessly.

4. Backed by a Trusted Company

Cash App is developed by Block, Inc., a well-established and trusted company in the fintech space. The backing of a reputable organization provides users with an added layer of security and confidence when engaging in cryptocurrency transactions. Knowing that your investments are managed by a reliable entity can enhance peace of mind while navigating the sometimes volatile world of cryptocurrencies.

Step-by-Step Process for Buying Bitcoin on Cash App

Now that we’ve covered the advantages of using Cash App for purchasing Bitcoin, let’s walk through the process step-by-step:

Step 1: Download and Set Up Cash App

If you haven’t already done so, download Cash App from your device’s app store (available on both iOS and Android). Once downloaded, follow the prompts to set up your account by entering your phone number or email address and linking your bank account.

Step 2: Navigate to the Bitcoin Section

After setting up your account, open Cash App and tap on the “Investing” tab located at the bottom of your screen. From there, select “Bitcoin.” This section will provide you with all necessary information about Bitcoin prices and trends.

Step 3: Buy Bitcoin

To purchase Bitcoin, tap on “Buy” within the Bitcoin section. You will then be prompted to enter the amount you wish to invest (remember, you can start with just $1). After entering your desired amount, review your order details before confirming your purchase.

Step 4: Manage Your Investment

Once your transaction is complete, you can manage your investment directly within Cash App. You can choose to hold onto your Bitcoin or sell it whenever you wish through the same interface.

Step 5: Send Your Bitcoin (Optional)

If you wish to send your newly acquired Bitcoin to another wallet or share it with friends using Cash App’s “Send” feature, simply navigate back to the Bitcoin section and select “Send.” Follow the prompts to complete this transaction securely.

Drawbacks of Cash App Investing

Despite its many advantages, Cash App Investing is not without its drawbacks. One of the most significant limitations is its lack of advanced investment tools. For beginners who may appreciate comprehensive market analysis or sophisticated charting capabilities, Cash App falls short. As a result, even novice investors might find themselves lacking critical information that could enhance their decision-making process.

Another notable weakness is Cash App’s limited investment selection. Currently, users can only invest in stocks and Bitcoin; options trading, bonds, futures, mutual funds, and other cryptocurrencies are not available on this platform. This limitation can be particularly concerning for those who wish to build a diversified portfolio or explore various asset classes. If your investment strategy involves complex instruments or a broader range of assets, Cash App may not align with your goals.

The Importance of Diversification

Diversification is a cornerstone principle in investing that helps mitigate risk by spreading investments across various asset classes. A well-diversified portfolio can buffer against market volatility and improve long-term returns. Unfortunately, with Cash App’s restricted investment offerings, users seeking to create a balanced asset allocation may find themselves at a disadvantage.

Investors looking for greater flexibility might consider exploring other platforms that offer more comprehensive investment options. These platforms typically provide access to different asset classes and advanced analytical tools that can help inform your strategy.

Cash App Investing vs. Other Trading Platforms

Cash App Investing has emerged as a popular choice among beginner traders, positioning itself as an accessible option for those looking to dip their toes into the stock market. However, when compared to other platforms such as Robinhood and traditional brokerage firms like Charles Schwab, Cash App Investing offers a unique blend of simplicity and affordability, albeit at the cost of advanced features.

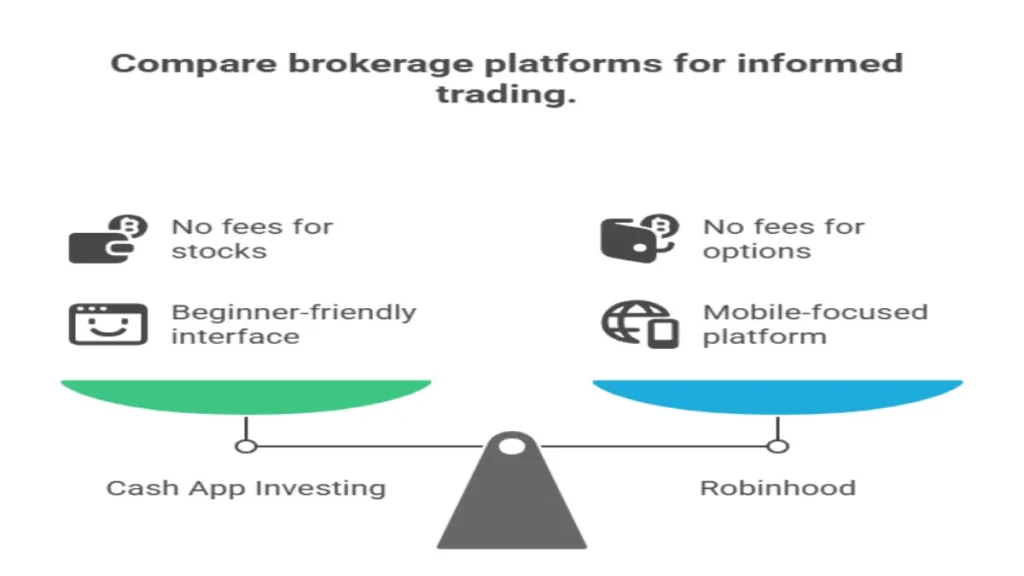

Comparing Features: Cash App Investing vs. Robinhood

Robinhood is perhaps the most direct competitor to Cash App Investing, sharing several similarities in terms of fee structure and mobile accessibility. Like Cash App, Robinhood offers commission-free trading on stocks, ETFs, and options, but it distinguishes itself with a broader range of investment types and features.

Robinhood’s platform includes options trading, cryptocurrency investments, and margin trading capabilities—features that attract more experienced investors seeking diverse opportunities. Additionally, Robinhood provides users with access to educational resources and market data that can enhance their trading strategies.

When it comes down to choosing between these two platforms, it ultimately depends on your level of experience and your investment goals. If you are a beginner looking for an easy entry point into the stock market without any frills, Cash App Investing may be your best bet. However, if you’re interested in expanding your portfolio with various asset types and require additional tools for analysis, Robinhood could be more suitable.

Traditional Brokerage Firms: A Different Ballgame

For those seeking advanced investing capabilities or comprehensive financial services, traditional brokerage firms like Charles Schwab present another alternative worth considering. While they may come with higher fees than both Cash App Investing and Robinhood (though Schwab also offers $0 commissions), they provide robust customer support services along with extensive research tools.

Charles Schwab caters particularly well to advanced investors who value detailed analytics and personalized service. Their platform allows access to a wider array of markets—from stocks to bonds—equipping users with an arsenal of investment tools that can help optimize their portfolios over time.

While these traditional brokers may not have the same user-friendly appeal as cash app-based platforms, they certainly offer depth for those willing to invest time in learning about various financial products.

Tips for New Investors

If you’re new to investing through Cash App or investing in general, here are some tips:

- Start Small: Begin with small investments until you become more comfortable with how the stock market and cryptocurrency work.

- Research Before You Invest: Take time to research companies and cryptocurrencies before making any purchases.

- Diversify Your Portfolio: Avoid putting all your money into one stock or asset; instead, diversify across different investments to mitigate risks.

- Stay Informed: Keep abreast of market trends and news that may affect your investments.

Conclusion

Cash App has made investing more accessible than ever before by integrating stock trading and cryptocurrency investments into a single platform. With its user-friendly interface and innovative features such as fractional share purchasing and easy access to Bitcoin trading, anyone can take their first steps into the world of investing without feeling overwhelmed.

Buying Bitcoin on Cash App offers numerous advantages that cater particularly well to newcomers in cryptocurrency investing. With low starting amounts, an intuitive design, easy transfer options, and backing from a trusted company like Block, Inc., it’s no surprise that many people are turning to Cash App as their go-to platform for cryptocurrency purchases.

While Cash App Investing presents an affordable and straightforward entry point for new investors, it’s essential to weigh its limitations against your financial goals. If you’re looking for an easy way to start investing in stocks or Bitcoin without requiring extensive tools or options for diversification, Cash App could be a good fit.

Cash App Investing presents an excellent option for beginner traders who prioritize simplicity and minimal fees in their investing journey. While it lacks some features offered by competitors like Robinhood or traditional brokerage firms such as Charles Schwab—such as advanced analysis tools or diverse investment options—it remains an ideal starting point for many new investors.

Call to Action

Ready to take control of your financial future? Download Cash App today and start investing in stocks and Bitcoin with confidence. Best regards, Finance Mate Club